VWAP TRADING STRATEGY

A quality video-guide, with which you will get started indicator VWAP and open the doors to becoming a successful trader.

The video-guide is designed so that you can understand the use of vwap indicator, master basic entry and exit strategies, study market forces, and learn how to manage your trading capital.

“VWAP trading strategy” – video course written by a professional who has years of experience.

In this course you will learn:

- How to setup Volume-Weighted Average Price

- How to work with indicator

- How to do your market analysis

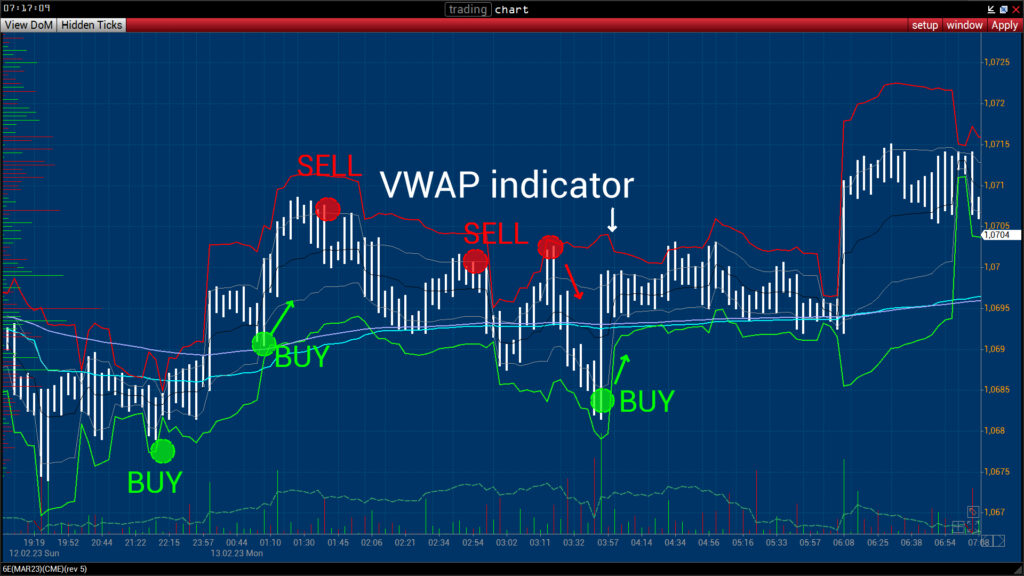

- How VWAP works with Standard Deviation

- VWAP strategy that you can immediately put to use

- How to manage your positions

- What are the most common trading mistakes

- The exact ways and rules I apply to my own trading

The VWAP indicator is used by hedge funds and investment banks, HFT companies.

trend confirmation determination of the favorable price of a trade transaction setting target levels positioning

Easy to apply, understand and use. Add an indicator to the chart - and it is ready to help you earn. Try it! Now!

This video course explores advanced action indicator VWAP. VWAP indicator is one of the underestimated indicators, moreover, traders confuse it with moving averages or ” moving” indicators. It is easy to learn and easy to integrate into a trading strategy. The advantage of using the indicator is a significant simplification of the trading process and analysis of market activity.

What you’ll learn:

– How VWAP indicator works

– What is its effectiveness and advantage

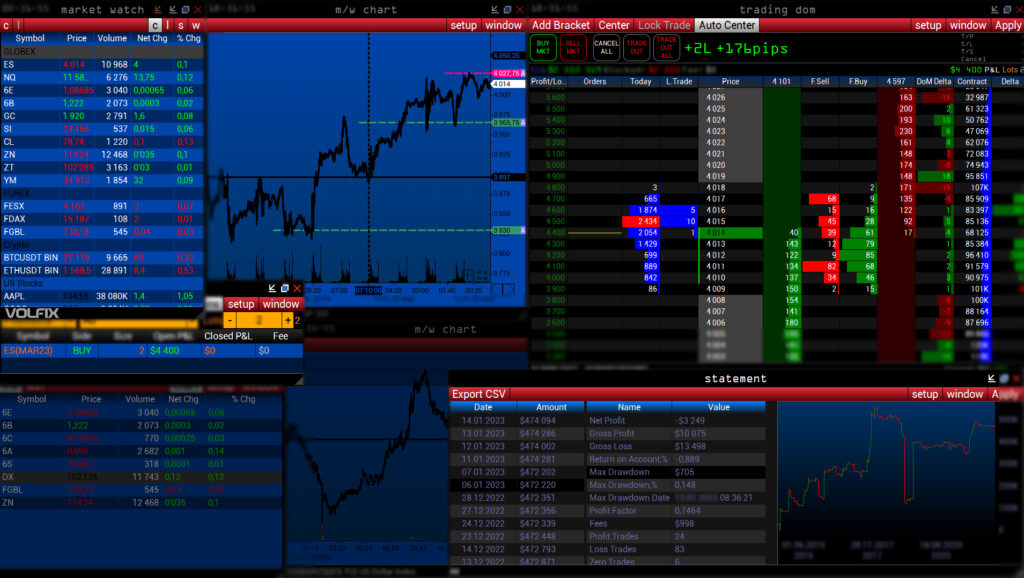

– How to set up the platform VolFix and indicator

– How the indicator will improve your analysis and price prediction

– How to properly analyze the standard deviation

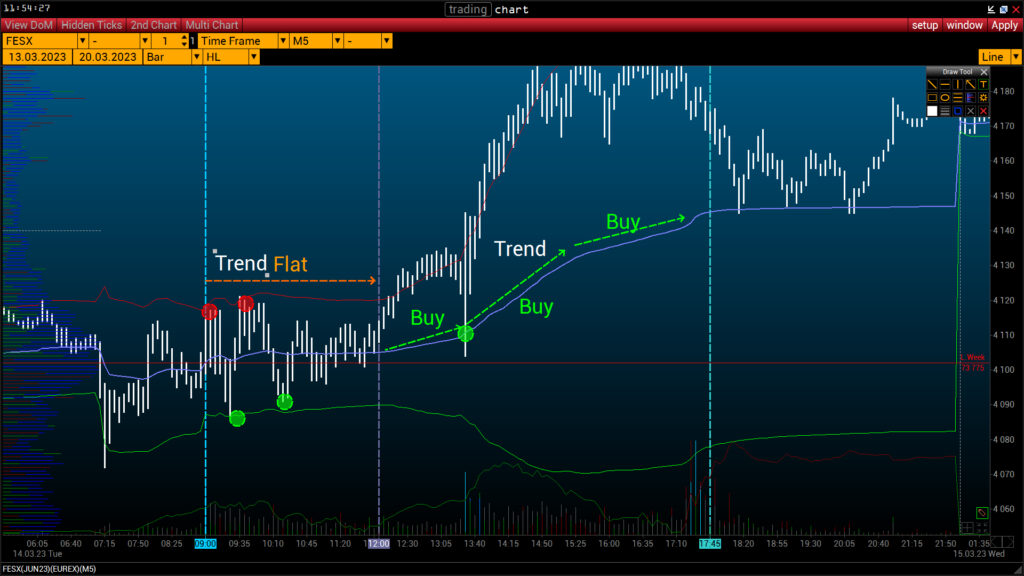

– How to spot a trend easily

– How the indicator will help manage risk and profit

Abbreviation of the indicator Volume-Weighted Average Price – weighted average price including trading volume. Institutional traders and investors have been using it since 1984.

Proven over time, the indicator has been noticed by HFT companies and now in 70% of high-frequency algorithms VWAP indicator is used.

- Detection of intraday trend and its changes

- Price Positioning

- Determination of a profitable buy/sell price

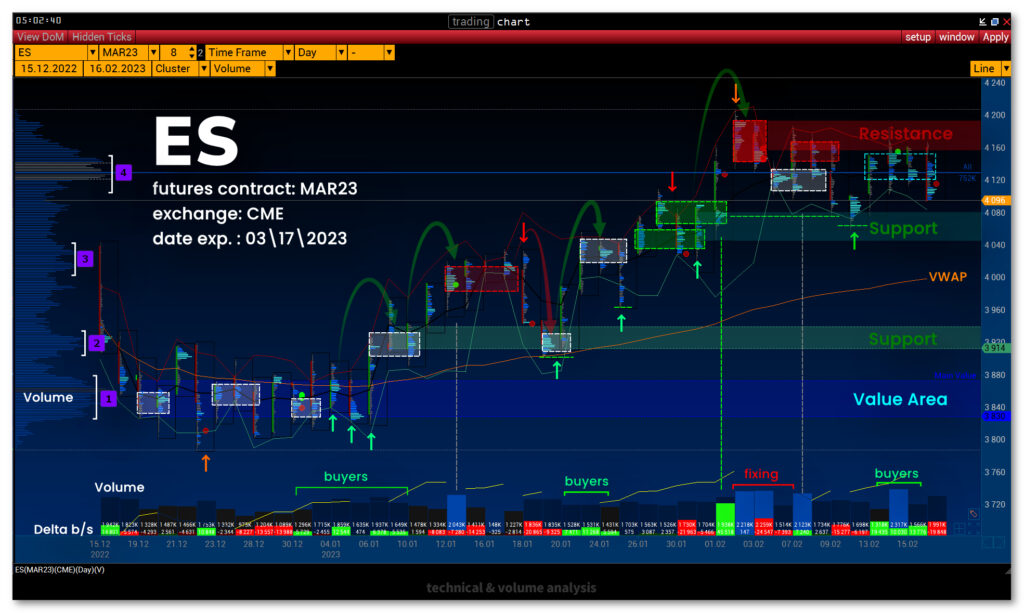

- Potential support/resistance price ranges

VWAP is used in different ways by traders. Traders may use VWAP as a trend confirmation tool and build trading rules around it.Traders and analysts use the VWAP to eliminate the noise that occurs throughout the day, so they can gauge what prices buyers and sellers are really trading at on the stock or the market.

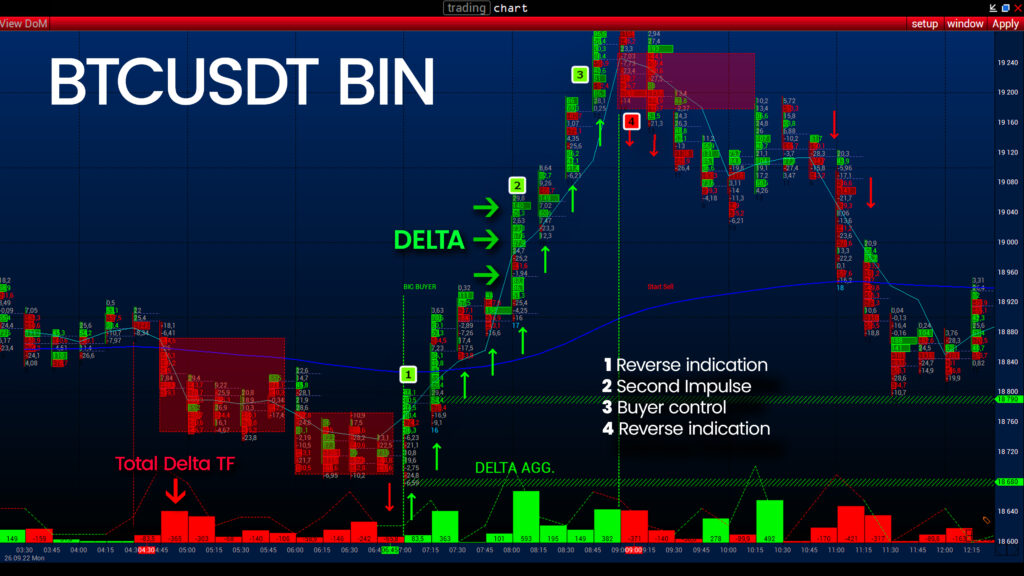

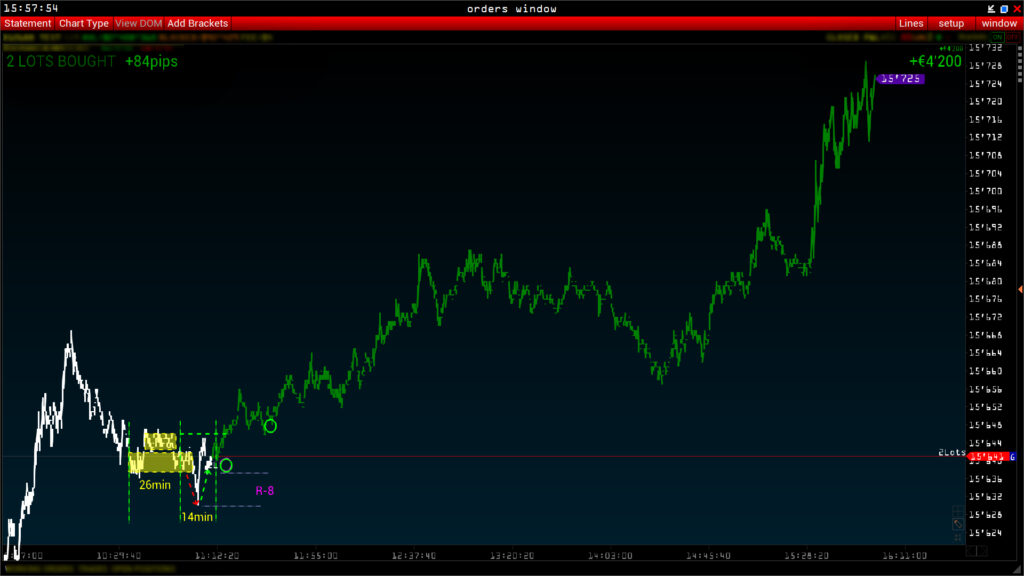

One crucial factor to consider is the benefits of combining signals from a range of different indicators. VWAP is helpful, but a buy or sell signal confirmed by another indicator such as Dom Level 2, Bid/Ask Imbalance, Time & Sales will have a higher probability of being correct.

Get a solid understanding of the volume-weighted average price.

Have the confidence and knowledge for daily trading.

Learn a proven and accurate strategy based on the VWAP indicator.

Learn how to apply the indicator on every trade.

Acquire the skills you need to trade any exchange market.

Get 5 videos, exercises and interactive content.

Learn 5 video lessons:

– Understanding the Volume-Weighted Average Price.

– VWAP setup in Volfix platform – chart and standard deviation range.

– Step-by-step guide & rules of analysis.

– Intro-day Trading Strategy.

– Trading examples and common patterns.

This online course is for: complete beginners to semi-experienced day traders.

Traders who want to complement and improve the quality of their strategy with the help of VolFix advanced tools.

Many of our members trade futures exclusively. As long as the markets you’re focusing on are consistently liquid — ES, NQ, CL, GC, etc. — then you’re good to go. We even have traders that focus on currency and bond futures as well.

A lot of our available video lessons use equities charts and terminology to initially teach our strategy, but the same concepts are directly applicable to futures.

We actively track and evaluate the S&P and NASDAQ E-minis through the lens of VWAP every day — identifying key levels to watch and providing commentary on the trickle-down effect their performance has on equities and other markets.

Active support throughout the month – skype-chat.

You will be able to understand complex issues, mastering new techniques step by step under the strict supervision of our mentors.

If you have any questions, here is a quick tip.

How best to ask and get the right answer:

– Create a screenshot of the program module that will help the mentor identify a possible error or problem.

– In the support chat, compose a message with a question about the topic you are studying in this video course.

– Attach a screenshot file to the message (no links) picture file resolution – PNG, JPEG.

Until the day this course is available for purchase.

Pre-order to get the discounted price.

Pay when the course is available.

Video course at the final stage of completion.

Will be available for purchase in a few weeks.

The cost of the pre-order course – 199 euro

Course cost after publication – 399 euro