16

LESSONS

16+

VIDEOS

All

SKILL LEVELS

10+ Hours

DURATION

English

LANGUAGE

New VolFix. New Opportunities.

Volume Analysis’ Praxis — is a two-month comprehensive preparation aimed at providing you with strategies on the stock and futures markets, currencies, and cryptocurrencies! You’ll receive professional platform setting methods from VolFix Academy traders. The training program covers all topics of volume analysis combined with technical analysis and the analysis of market microstructure.

The training program is entirely based on the updated VolFix platform version and includes new, unique tools as well as setup processes for all assets of interest. “Insiders” can now be identified, and no algorithms go unnoticed!

With Volume Analysis’ Praxis you’ll receive a method that has been working for over 10 years and continues to evolve with the markets, no matter what happens! Once you understand our methods, you can develop your own strategy and implement it in practice!

Your trading will never be the same again!

Who is our training program designed for?

What have we prepared

for you

in Volume Analysis’ Praxis?

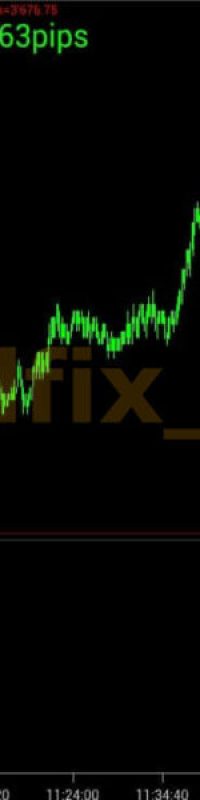

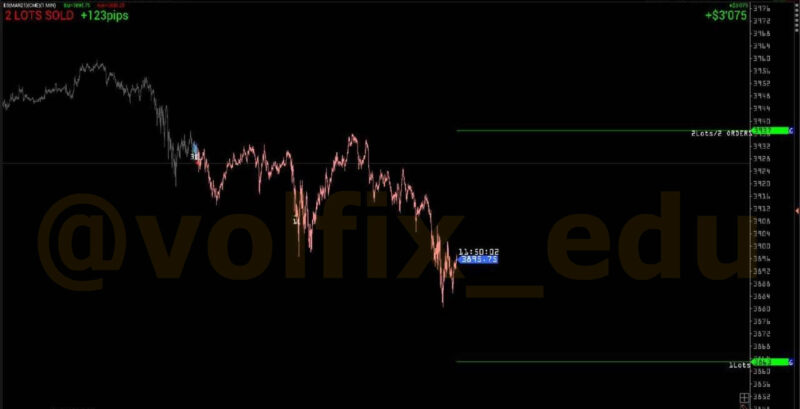

• Find promising trades using classic market analysis techniques and supplement with volume information.

• Recognizing and applying volume models.

• Working with trading phases (balance, impulse).

• High-precision reversal identification.

• Effective momentum continuation moments.

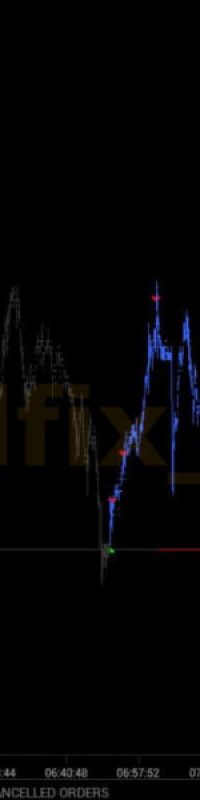

• Meaning and application of Delta, Bid/Ask.

• Level adjustment and application.

• Use of volume events for risk minimization.

“Everything that happens on a chart can be described by the change in extremes, their speed, large trades, and the price reaction to these.”

“The art of active trading is the ability to hold two mutually exclusive thoughts in one’s head simultaneously without losing the ability to make a decision.”

Features of the curriculum:

• The program is compiled by the inventors of the volume method, the VolFix Academy Team.

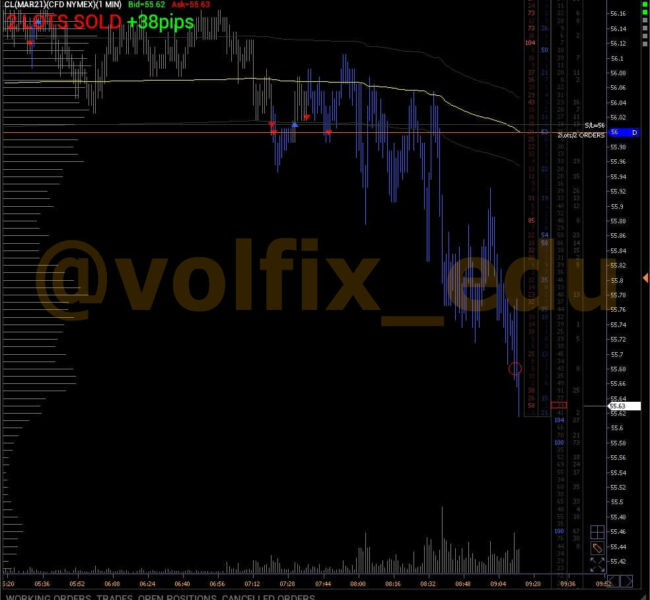

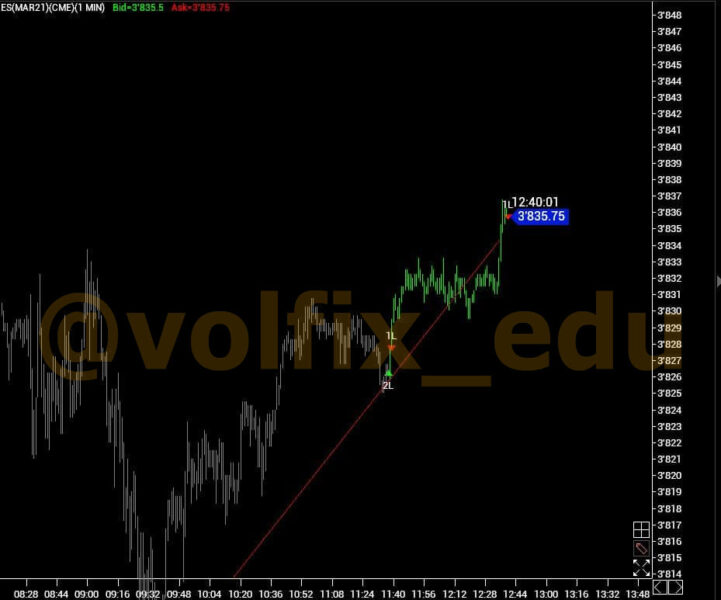

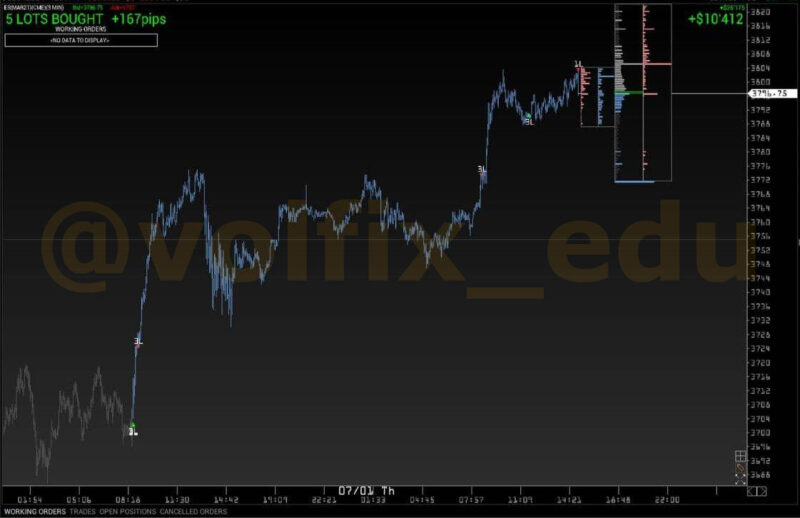

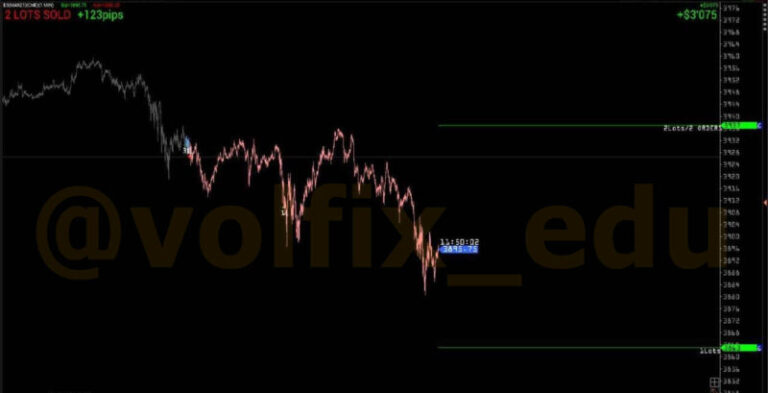

• The theory is practiced with practical examples.

• Effective presets for various assets and “signal” charts.

• Best feedback and results after completion.

• All available exchange packages for the entire training period (2 months).

• Best price-performance ratio

Special

Analysis tools

Volume

The Auction Delta

Bid/Ask Aggressor

Order Flow

Time & Sales

Market Profile

Point of Control

Depth of Market

Balance/Impulse

Value Area

Special Charts

Market Replay

Assets

and Exchanges

EUREX

CME

NYMEX

NYSE

NASDAQ

CBOE

COMEX

OIL GOLD

INDEX

ETF

BITCOIN

CRYPTO

Process organization:

Price: €1490 €1290

Organizer: VolFix Academy

Teaching form: Video courses on the website with unlimited access

Number of courses: 16 lessons – 10+ hours of practice and theory (training duration – 2 months)

Benefits: Liberty Market Investment 50K package + special VolFix platform subscription terms

• The program is compiled by the inventors of the volume method, the VolFix Academy Team.

• The theory is practiced with practical examples.

• Effective presets for various assets and “signal” charts.

• Best feedback and results after completion.

• All available exchange packages for the entire training period (2 months).

• Best price-performance ratio

Special

Analysis tools

Volume

The Auction Delta

Bid/Ask Aggressor

Order Flow

Time & Sales

Market Profile

Point of Control

Depth of Market

Balance/Impulse

Value Area

Special Charts

Market Replay

und Börsen

EUREX

CME

NYMEX

NYSE

NASDAQ

CBOE

COMEX

OIL GOLD

INDEX

ETF

BITCOIN

CRYPTO

Price: €1490 €1290

Organizer: VolFix Academy

Teaching form: Video courses on the website with unlimited access

Number of courses: 13+ lessons – 9+ hours of practice and theory (training duration – 2 months)

Benefits: Liberty Market Investment 50K package + special VolFix platform subscription terms

WATCH THE INTRODUCTORY WEBINAR AND A SESSION EXCERPT TO GET AN IDEA OF THE CLARITY, USER-FRIENDLINESS, AND STRUCTURE OF THE MATERIAL

Our goal:

WHAT DO THE FIRST PARTICIPANTS SAY

Some of feedbacks were translated

“The reason for the change in direction of prices is the imbalance between supply and demand. It’s hard to argue with this statement since a $100 trade cannot have the same consequences as a $1,000,000 trade. Knowing the trading volume is a clear advantage when assessing the risks and prospects of each individual deal.”